This post explores ways for you to move past rough estimates and take a closer look at your spending. When you review your net worth and personal cash flow, and really know your numbers, you can make better financial decisions. This approach helps you re-focus on your savings priorities. It can also lead to better, tax-aware decisions. The math of your finances is just one part of this approach. Visualizing your numbers can help you stay focused on what matters. Most importantly, you’ll be more inspired to stick to your plan when you give your money meaning. It’s about aligning your personal finances with your values and goals.

Learning Points

Going Beyond the Mental Math of Spending

A lot of us keep track of our personal cash flow figures using mental math. In our minds, we say things like, “I only spend ‘$X’ on that stuff, or we’re saving ‘$Y’ towards this goal, or our subscriptions are around ‘$Z’ per month.”

The reality of our spending is usually different than our perception of our spending. And guess what? That’s O.K., as long as you recognize it, and review your actual spending. Trust but verify.

That’s what makes reviewing your net worth and personal cash flow helpful. You are reviewing your actual results.

Once you have the data, you can make educated, data-driven decisions on how you will approach spending your hard-earned income in the future. You can reflect on what you enjoy spending money on, what you want to be saving towards, and where you might need to update your goals or savings priorities.

For example, does your cash flow allow you to increase your savings in your emergency fund? Does it make sense for you to open and fund an HSA? What are the benefits of opening and funding a 529 account for each of your children? Or is it time to get your essential estate planning documents in place?

Paint a Picture: Visualizing Your Personal Cash Flow

Once you finish your cash flow projection, consider making a quick visual of your high-level cash flow projections.

It’s another way to bring the numbers to life, to simplify and clarify where you’re at financially.

It’s a useful graphic tool for that person in your life who is interested in all of this, but who might not get as energized as you about looking at spreadsheet.

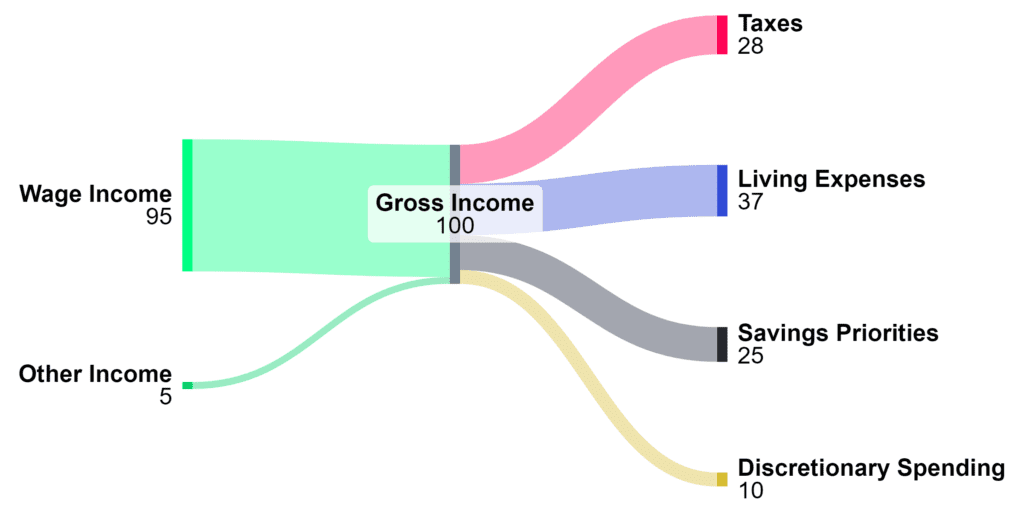

One simple example of this is a Sankey diagram, like the one below:

Notice how this diagram simplifies your cash flow into 4 main categories.

Giving Your Money Meaning

This simplified approach can empower you to worry less about the little things you spend money on.

Instead, a simplified view of your finances can help you shift your focus to your savings priorities and to not worry about spending on the things that you find valuable or meaningful.

Value and meaning can come from experiences like a cooking class with your best friend or family vacation. It’s that new pair of sunglasses for the family trip, that dress you keep thinking about for the concert you’ve been planning to see with your sister for 6+ months, or a new tool for the garage that’ll make the next project with your dad easier.

Notice in the diagram how the spending starts with taxes at the top. That category of spending is always going to be in your life. There are things you can do that reduce how much you pay in taxes. For example:

- Contributing to your 401(k) and HSA

- Asset location

- Charitable deduction bunching

- Tax-efficient withdrawals

- Tax-loss trading

- Education funding (e.g. 529 account contributions)

The next category in the diagram is living expenses. When your money has meaning, it can be easier to keep your living expenses lower than they might otherwise be. It allows you to intentionally spend in a way that is aligned with your values and goals.

That doesn’t mean you skip those little things that bring you joy. It does mean you analyze the long-term tradeoffs of leasing the vehicle you want versus buying the vehicle your family needs.

When you are able to keep your living expenses steady, you’ll start to achieve remarkable saving toward your goals. You can purposefully avoid lifestyle creep. Before you hit “Buy” the next time online. Ask yourself, “Do I need this, or do I want this?”. Only you are going to know the right answer to that.

When you do these kinds of things, you can increase the odds of your success as your income increases.

So, as your income increases with knowledge/experience, increasing responsibility, being in the right place at the right time, and thoughtful career management, focus those wins back to your savings priorities.

When you’re comfortable that you’re minimizing your taxes, your living expenses are dialed in and aligned with your values, it becomes easier to save the right amounts toward your future goals/savings priorities.

The Next Step

When you know who and what are truly important, you can create incredible clarity about your spending and saving.

Clarity to confidently spend on things that matter. Clarity to avoid spending your hard-earned resources on things that aren’t aligned with what you want in life.

The sooner you are able to thoughtfully execute on this approach, you’ll increase the likelihood of achieving your goals, setting new ones, and enjoying the present moment.

As your financial planner in Saint Louis, we can help you plan for the future and enjoy the present moment.

Understanding your net worth and personal cash flow is essential for making informed financial decisions. By knowing your numbers and visualizing them, you can stay focused on what truly matters and align your finances with your values and goals. Working with your financial planner in Saint Louis can provide you with the right mix of accountability, collaboration, and long-term thinking.

To take one step toward controlling your financial future, start by downloading a personal net worth and cash flow report template.

My goal in creating this tool is to help at least one person who finds it useful. If it helps you move one step closer to understanding and improving your personal finances, that’s a win in my view. Customize it, make it work for you, and enjoy!

Disclosure

This commentary is provided for educational and informational purposes only and should not be construed as investment, tax, or legal advice. The information contained herein has been obtained from sources deemed reliable but is not guaranteed and may become outdated or otherwise superseded without notice. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decision.