Learning Points

Retirement Planning Awareness Overview

Whether you’re in your late 20s, 30s or 40s, you understand that saving and planning for retirement is a worthwhile long-term goal. You might share the view that retirement is not so much a specific destination, but a new vista from which to enjoy the next phase of your life.

You might believe that a successful retirement for you is shaped by a career shift, a change of scenery, or truly dedicating yourself to a lifelong passion. Or, you are passionate about some aspects of your career, and want to be able to focus more on those fun parts of your profession.

Decisions such as who you marry (or whether you want to marry at all), where you live, whether you want to raise a family, and your career have significant influence on your retirement path. These decisions require thought and reflection – though last I checked; true love did not have a dollar amount next to it. Other decisions are also worthy of some level of quantitative analysis or understanding.

With these larger, and arguably more important, life decisions as context for the rest of this discussion, let’s expand your retirement planning awareness of some relevant financial decisions that can influence your retirement path.

Specifically, the following list is not an exhaustive compendium, it does seek to cover high impact missteps to avoid, or course correct against.

Not Saving Enough Early On

Long-term goals like saving for retirement can feel, well, a long way off. It’s easy to prioritize other more pressing or near-term needs and wants.

“Retirement’ can feel fuzzy without some real math and thoughtful planning. Investing can feel as foreign as another language or as unending as Sisyphus’s toils. Whatever the reason, not saving for retirement early enough in your life can make it more challenging to achieve your retirement goals later in life.

Once you determine how much you need to contribute to your retirement savings, prioritize it. Automate saving that amount regularly.

When you know how much you need to save and automate saving toward your goal, you are improving your retirement planning awareness. You know your numbers and have an actionable plan.

Raise your retirement planning awareness around regular contributions to your retirement accounts, even small ones, can add up over a long investing time horizon. Your early contributions have more time to compound than later contributions.

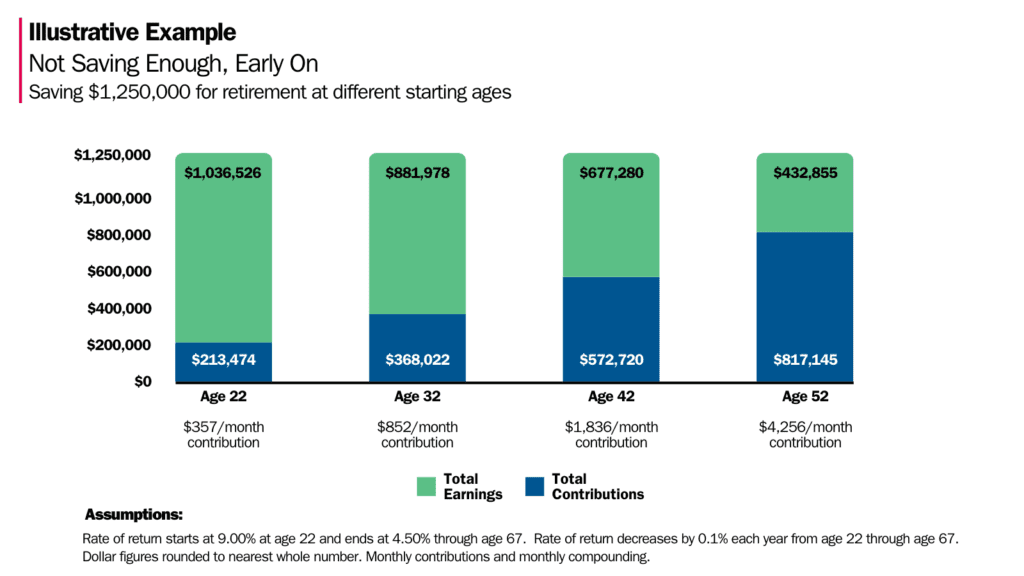

The illustrative example below highlights the difference in how much a retirement saver needs to contribute each month starting at four different ages. This illustrative example shows that the later you start saving for retirement, the more you need to contribute compared to someone who started earlier.

Compounding allows your investments to grow by generating earnings on both your original principal and the accumulated returns over time. That doesn’t mean your retirement investments are not susceptible to losing value. Market growth and decline are out of your control. You can control saving the right amount of money throughout each year.

With this approach, you give your investments more time to capture the expected market returns over the relatively long time-horizon associated with the average retirement saver.

Saving or Spending Without Intentionality or Tracking

When your money has meaning, it can be easier to intentionally save and spend your money in ways that are aligned with your values and goals.

That doesn’t mean you skip the little things that bring you joy. It does mean you analyze the long-term tradeoffs of high dollar decisions, especially hard to reverse decisions.

The reality of our spending is usually different than our perception of our spending. And guess what? That’s O.K., if you recognize it, and review your actual spending.

Tracking your spending allows you to make educated, data-driven decisions on how you will approach spending your hard-earned income in the future. You can reflect on what you enjoy spending money on and what you want to be saving towards. As your life evolves, you can adjust to the changes and where you might need to update your goals or savings priorities.

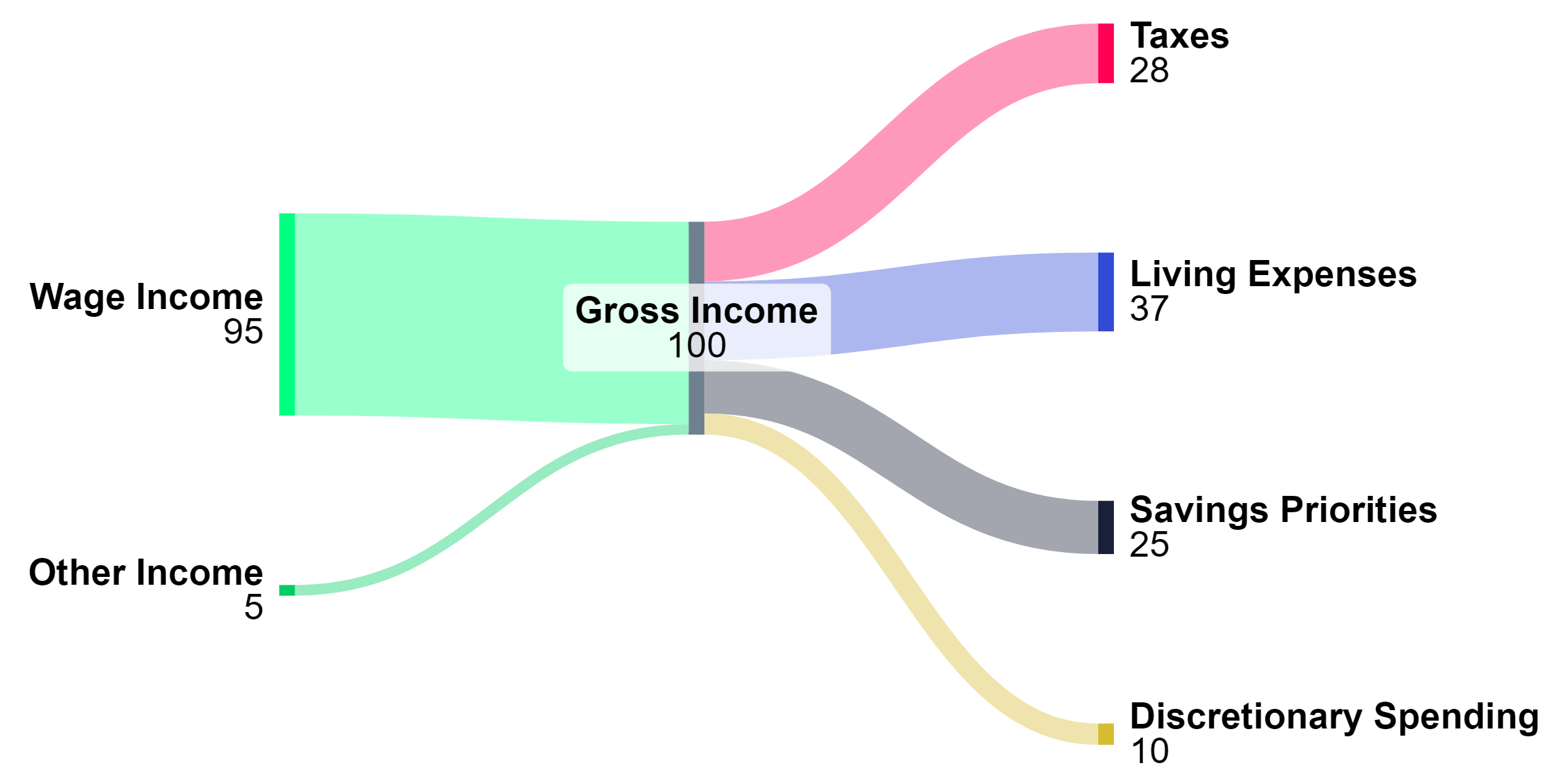

A simplified view of your finances can help you shift your focus to your savings priorities and to not worry about spending on the things that you find valuable or meaningful.

Limited Investment Approaches in Your Retirement Accounts

It can be tempting to invest in a small number of specific companies, popular industries, or a single mutual fund. However, when you concentrate a material portion of your wealth into a single company, or a single asset class, you often increase the overall risk of your investments. When you do this intentionally (e.g. founding a high growth company), it’s important to understand how this influences your retirement planning. It’s worth examining whether you’re doing this unintentionally. For example, by believing in your employer’s mission and buying a disproportionate amount of company stock relative to your other investments. Or, by participating in an executive compensation plan and not factoring it into your overall financial plan.

This can also be true when you have a significant financial exposure to your own company’s equity performance and earn compensation (e.g. salary, bonus, profit sharing, etc.) from the same company.

Specifically, you are not reducing unsystematic risk – the risk associated with individual stocks or sectors.

When you increase the diversification of your retirement investments, you can reduce unsystematic risk in your investments. This can leave your retirement investments exposed to predominantly systematic, or market-wide, risk.

You can expand your retirement planning awareness by understanding how your retirement accounts are invested, and in part by understanding how much diversification they create.

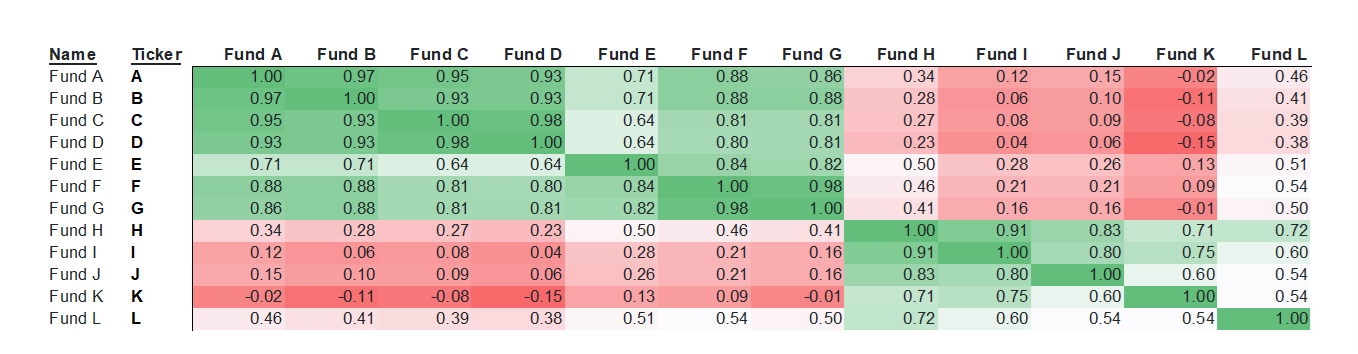

At a practical level, understanding correlation is a key measurement of your investments’ diversification.

Correlation measures how two different assets, or investments, move in relation to each other. By selecting assets with relatively low or negative correlations to one another, you can lower the unsystematic risk of your retirement investments.

The asset correlation chart shows the correlation coefficients of hypothetical mutual fund options found in a retirement plan. When you’re reviewing correlations, you’ll want to consider your investment time horizon. Assets can have different correlations over short and long-term periods.

Here are three observations from this illustrative correlation matrix:

- Fund A and Fund B have a relatively high correlation (0.97).

- Fund D and Fund K have a negative correlation (-0.15).

- Fund C and Fund E are moderately correlated at (0.64).

When your investments can better balance the potential ups and downs of the markets through proper diversification, you can bolster the stability potential of your retirement savings over your investment time horizon.

Contributing Amounts Below the Company Match Threshold

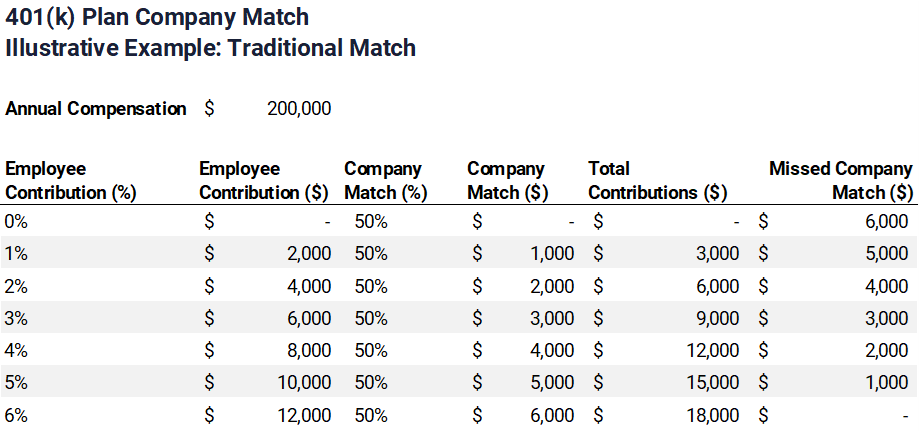

An employer 401(k) plan matching program is a benefit that many companies offer their employees and one that retirement savers should try to maximize each year. Specifically, if your employer offers this benefit, the employer is incentivizing your retirement savings.

How? By matching a percentage of your salary that you contribute to the company retirement plan up to a specific dollar amount.

- Traditional matching contribution: Under this design, the employer matches a certain percentage of the employee’s contribution, up to a certain limit. For example, an employer might offer a 50% match on the first 6% of an employee’s salary that the employee contributes to their retirement plan.

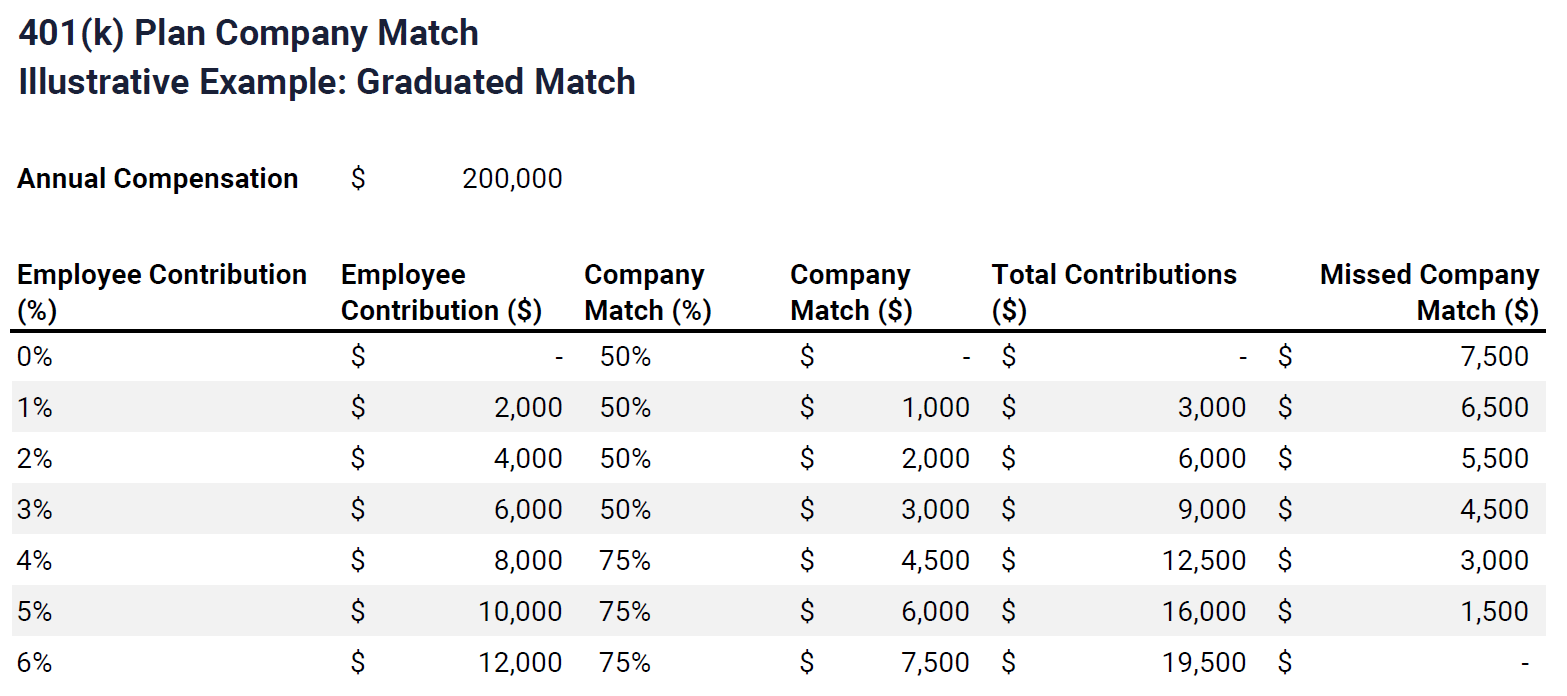

- Graduated matching contribution: Under this design, the employer’s match increases as the employee’s contribution level increases. For example, the employer might offer a 50% match on the first 3% of an employee’s salary, and a 75% match on the next 3%.

You can expand your retirement planning awareness by understanding the details of your employee benefits generally, and in particular, how to achieve the full company match.

If you’re not contributing enough to receive the full match amount offered, you’re essentially walking away from free money. Take time to understand your employer’s specific matching contribution, and make it a priority to contribute, at the very least, an amount that allows you to receive the full company match.

Skipping Contributions to a Roth 401(k), Roth IRA

Traditional 401(k)s and traditional IRAs can be useful retirement accounts for retirement savers like you.

These two account types are tax-deferred accounts; your contributions are made with pre-tax dollars. Which means you won’t pay taxes until you start distributing money out of the account. Any qualified withdrawals/distributions are taxed at your ordinary income rates at the time of the distribution.

Depending on your personal situation, your pre-tax contributions to these accounts can potentially lower your taxable income in the current year. Your traditional 401(k) and traditional IRA contributions can also grow tax-deferred until you withdraw them.

You can expand your retirement planning awareness by understanding how a designated Roth 401(k) or Roth IRA fit into your retirement plan.

Specifically, it can also be beneficial to have a source of after-tax savings when you want to spend the money you’ve been saving for retirement. Enter the designated Roth 401(k) and Roth IRA.

Your Roth 401(k) and Roth IRA contributions consist of after-tax dollars – money you’ve already paid income tax on. This allows your contributions to grow tax-free. It also means when you spend the assets in these accounts during your retirement, the contributions and growth can be tax-exempt.

When used in combination with pre-tax retirement sources, after-tax accounts can help lower your taxable income. There is not a clear-cut solution for everyone. Thoughtful investment tax planning should consider things like your personal situation like your marginal tax rate, retirement goals, and sources of income.

A Practical Perspective on IRAs: Which IRA Can I Contribute to in 2024?

Your income, tax filing status, and whether you have access to a workplace retirement plan determine your IRA contribution eligibility. You can expand your retirement planning awareness by understanding which IRA you can contribute to in any given tax year.

For investors who i) choose the married filing jointly tax election and ii) are covered by a workplace retirement plan, the following chart illustrates which IRAs you can contribute to in 2024 based on your income.

Think of the chart below as an empty glass. As you pour more income into it, the fewer account type choices you have available at the top of the glass. For example, after you reach a MAGI greater than $240,000, your IRA contributions are limited to non-deductible IRAs.

You’ll notice that the chart above shows the income ranges where specific account types and tax treatments gradually become less available. These are the “phase-out” ranges. If your income is in a phase-out range, the amount you can contribute decreases from the standard amount based on an IRS formula.

At the top of the chart, there are no maximum income limitations for non-deductible IRA contributions in 2024. To be clear, you do need to meet the earned income requirements. Alternatively, you can choose to invest in a taxable account.

The Next Step

When you know where you’re going financially and know who and what are truly important to you in life, you can create incredible clarity about your spending and saving.

You can confidently spend on the things that matter, and confidently decline to spend on things that aren’t aligned with what you want in life.

Whether you are in your 20s, 30s, 40s, or 50s, expanding your retirement planning awareness can help you better understand common misconceptions and avoid potential blind spots in your own financial life.

Learning from other investors’ retirement planning missteps can help you identify and adjust elements that take you closer to where you want to be financially.

The sooner you can thoughtfully execute on this approach, you’ll increase the likelihood of achieving your goals, setting new ones, and enjoying the present moment.

Frequently, proactive and open collaboration with your tax and estate planning professionals can help you work towards your financial planning goals. Working with your financial planner can provide you with the right mix of accountability, collaboration, and long-term thinking.

Disclosure

This commentary is provided for educational and informational purposes only and should not be construed as investment, tax, or legal advice. The information contained herein has been obtained from sources deemed reliable but is not guaranteed and may become outdated or otherwise superseded without notice. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decision.