Term life insurance can provide your family with financial support should you unexpectedly pass away. Explore key factors, terms, and practical considerations in this educational overview.

Learning Points

Overview of Term Life Insurance

A term life insurance policy can provide your family with financial support should you unexpectedly pass away.

YOU CAN USE A TERM LIFE INSURANCE POLICY TO TRANSFER THE RISK of your unexpected death to an insurance company, rather than your family retaining that risk.

Your term life insurance policy is active for a pre-determined number of years – referred to as the term – and at the end of the term your policy expires with no maturity value. In return, you pay a set, annual premium each year your policy is active.

If you own a term life insurance policy, that policy only pays a death benefit during the policy’s term, and it has no savings component.

Your life insurance death benefits are also not taxable if your surviving spouse is the beneficiary.

The Role of Term Life Insurance for You and Your Family

A SENSIBLE TERM LIFE INSURANCE POLICY CAN PROVIDE YOU AND YOUR FAMILY with the following:

- A predetermined death benefit amount for surviving family members in the event of the policy owner’s death.

- Liquidity and available funds to pay for debts, taxes, and the costs of estate administration.

- Beneficiaries with an inheritance that has been shifted from one generation to another in a tax-efficient manner

Your Financial Needs Inform Your Term Length

AS A STARTING POINT, EVALUATE HOW YOU CAN MATCH the term of your policy with your largest liabilities, ongoing expenses, and savings needs.

For example, assess how your family would comfortably pay down debt, fund lifestyle/living expenses, educational expenses, and personal savings in your analysis. You’ll also want to factor in your existing savings and other life insurance coverage to create a complete understanding of your family’s insurance needs or gaps. Your potential needs should inform your term length(s).

When you create a thoughtful assessment of your needs, you can narrow down your policy options based, in part, on the specific term(s) you need.

Life insurance companies offer term policies with of varying, standard time periods. The more standard term lengths are 10-, 15-, 20-, and 30-years. Once you purchase a policy with a specific term, insurance companies will require you to go through a new application process if you want a policy with a different term.

While the insurance landscape continues to evolve, exploring level-premium term insurance is a good starting point for most couples and parents.

Your Financial Needs Inform Your Death Benefit Amount / Policy Value

EVALUATING DIFFERENT TERM LIFE INSURANCE DEATH BENEFIT AMOUNTS is a quantitative and qualitative process. Consider the following two hypothetical scenarios highlighting under- and over-insurance:

A WORKING, MARRIED COUPLE IN THEIR EARLY 30’s

- Three children under the age of 9

- Student loans of $125,000

- 30-year mortgage with principal balance of $500,000. There are 29 years remaining on the loan.

- A new, 10-year, $500,000 term life insurance policy for just one spouse is unlikely to provide as robust insurance coverage for this family as two, 30-year life insurance policies worth $2,000,000.

A WORKING, MARRIED COUPLE IN THEIR LATE 50’s

- Three children who have graduated from college

- Personal car loan of $12,000

- 30-year mortgage with principal balance of $125,000 with 6 years remaining.

- A new, 30-year, $1,000,000 term life insurance policy for both spouses is likely to create too much insurance coverage for this hypothetical family.

- Evaluating other life insurance options such as two, 10-year policies with $250,000 of coverage could create a more balanced solution.

Again, each of these scenarios highlights an example of under- or over-funded life insurance coverage.

While each scenario provides an incomplete picture of the family’s situation, here are a couple conceptual takeaways:

- There is no one-size-fits-all solution for life insurance.

- The details of your financial life, including your current income, expenses, additional assets, savings and insurance should inform your coverage amount.

- For many families, life insurance is intended to help maintain a current standard of living. In some cases, selling the family home is an option if downsizing is an acceptable outcome. For many families, such an outcome is unappealing.

It’s important to avoid simple rules of thumb, when you evaluate how much life insurance coverage you need.

You should explore a customized life insurance solution that truly protects your loved ones. A life insurance policy personalized to your life allows you the flexibility to build your financial resources and fund your savings priorities.

A life insurance policy can provide you and your family with a financial safety net. That safety net allows you to save for your retirement, your children’s education, or other priorities, rather than keeping large amounts of your cash readily accessible/liquid.

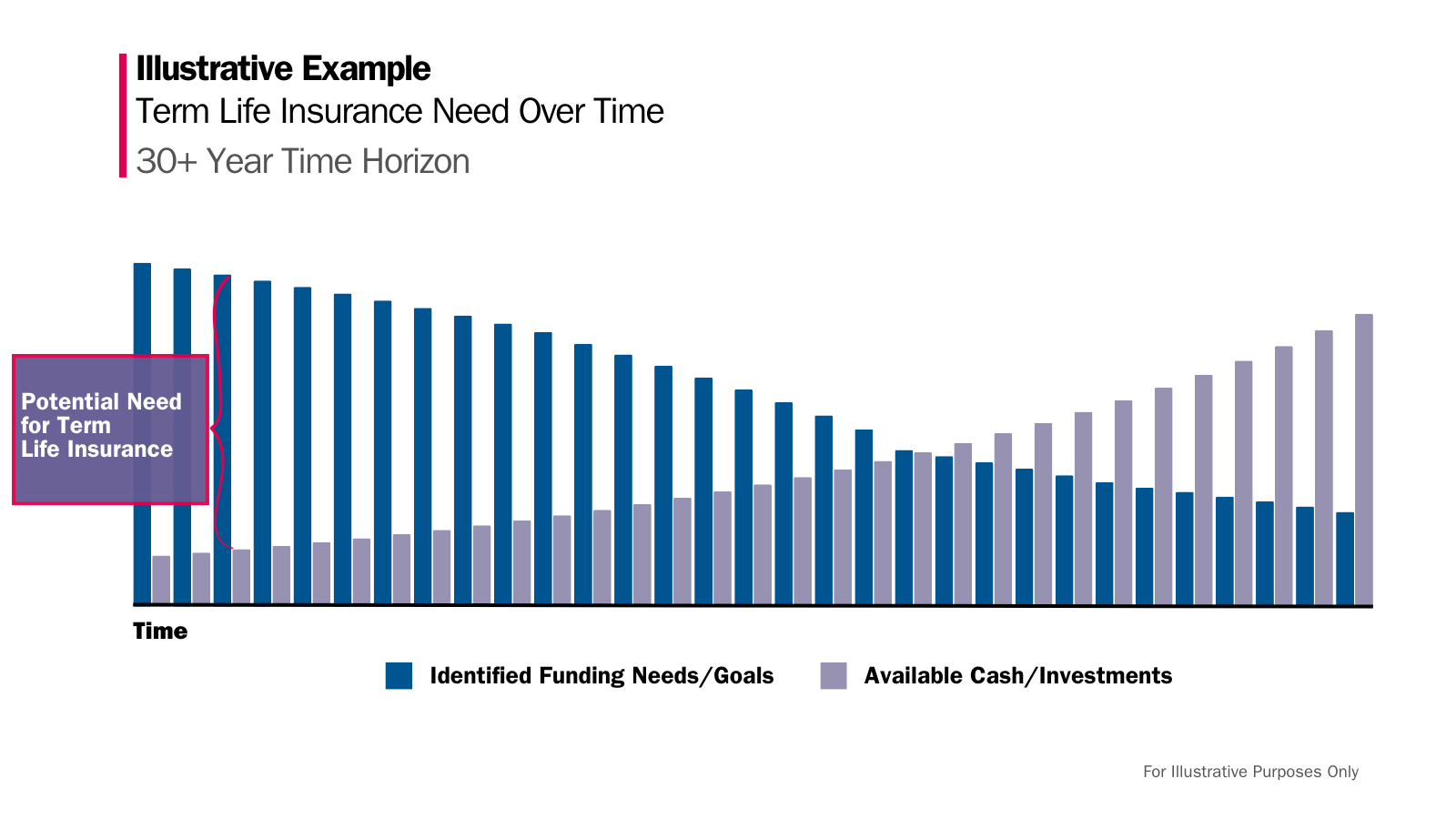

Below is an illustrative example of how term life insurance could fit into a family’s financial plan as they build up their savings and investments over time.

Individual Policy vs. Employer-Provided Group Term

As you get older, the cost of life insurance increases. Whether you’re considering a term life insurance policy with a 10-year or 30-year term, it’s helpful to evaluate policies that are not connected to your employer. The age you apply for life insurance will influence the premium on your policy.

The younger you are when you obtain a policy, the more favorable rates can be, all else being equal.

THE PREMIUM, OR PRICE, OF YOUR LIFE INSURANCE POLICY can be influenced by your individual risk factors like:

- Benefit Amount: the higher the death benefit amount, the more expensive.

- Term: the longer the term, the more expensive the policy.

- Age and Gender

- Family medical history

- Driving record

- Lifestyle and occupation

YOU CAN OBTAIN AN INDIVIDUAL TERM LIFE INSURANCE POLICY in lieu of the group life insurance offered through your employer.

As you think about your specific situation, consider that an individual policy provides you with the following:

- Portability: An individual term life insurance policy can allow you to avoid being dependent on your employer’s group life insurance policy, especially if it does not have a conversion privilege.

- Fixed Cost Potential: Depending upon the type of coverage you need, you can obtain a policy with a set annual premium – this is called a level premium. Prioritize your savings accordingly.

- Ownership and Availability: If it’s important for you to create certainty around your life insurance coverage, you own your individual term life insurance. Your employer owns the group provided insurance. If you are no longer working for your employer – through their choice or your own – your group coverage is eliminated.

- Increased Death Benefit: If you need a death benefit that exceeds the coverage limits of your employer’s basic and supplemental life insurance, an individual plan that provides adequate coverage for your family is worth evaluating.

As you reflect on your specific situation, consider the drawbacks and alternatives to an individual term life insurance policy:

- Static Benefit: Your financial needs might change before your policy ends. Therefore, your original coverage could be significantly more or less than you need. A group policy has some flexibility, oftentimes within specific constraints, to increase or decrease coverage amounts from year to year.

- Finite Term: Unlike whole life insurance, an individual term life insurance policy’s coverage is relatively temporary and expires after the stated term.

- Coverage based on individual risk factors: If you have a health condition that limits your ability to purchase an individual life insurance policy, a group policy might be a more cost-effective option.

- If you prefer a policy with cash value and/or investment components available through whole life insurance or universal life insurance. The premiums you pay do not create any equity position in the policy.

Oftentimes, a 20- or 30-year term policy can strike the right balance for those who need it most when you’re starting out.

Practical Considerations

Evaluate whether an individual term life or an employer’s group term policy best fits your specific situation.

Gather quotes and conduct due diligence on potential life insurance companies. Seek out unbiased, objective perspectives and information from professionals whose interests are aligned with your own.

If you apply for an individual term life or supplemental group insurance policy, you might need to go through medical underwriting before the insurance company will approve, or decline, your coverage. While medical underwriting is not onerous, it could add extra time to the approval process.

As your life changes and you discover that you need additional death benefits, explore additional solutions that bridge any gaps.

On a practical note, once you know which policy you need and how much your annual premium(s) will cost, automate saving for this priority.

An employer program can deduct premiums automatically from your paycheck.

An individual policy might require you to set up an automatic payment.

If you set up an annual, auto-pay option, you might receive a cheaper premium than if you paid quarterly or monthly.

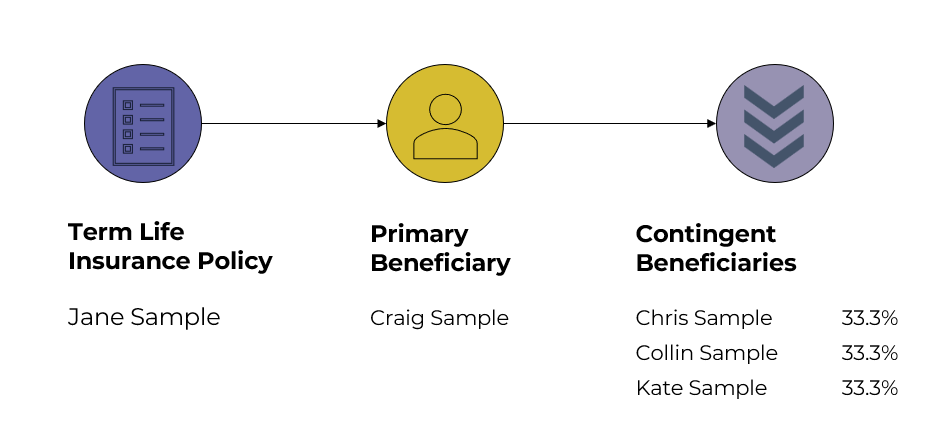

Remember to select your primary and contingent beneficiaries when you’re going through the life insurance application process.

Prioritizing your beneficiary designations matters. When you choose someone, or your trust, to be your account’s beneficiary, in most cases, that designation overrides any language you have in your will about the matter.

Evaluating the Financial Strength of a Life Insurance Company

As you evaluate different life insurance options, look beyond the premium cost relative to the death benefit. Price is a factor, but not the only factor.

Understand the financial strength of each life insurance company you’re evaluating. As a starting point, independent ratings reports are available from agencies like A.M. Best, Moody’s, and Standard & Poor’s. Typically, the reports are available on the life insurance company’s website. These ratings are independent opinions, created by each rating agency, of an insurer’s financial strength and ability to pay its insurance policies and contract obligations. It’s important that you not use these ratings as a specific recommendation to buy any term life insurance policy.

You’ll want to review the ratings reports for the life insurance subsidiary company. Not the life insurer’s parent company. Also, confirm the ratings reports are recent.

There should be a similar consensus from each agency’s report. Pay particular attention to the long-term financial strength of the life insurance company.

You want to obtain a life insurance contract from a company with strong financial health and reliability so it can meet its long-term obligations to you and your family.

Term Life Insurance: Key Terms

Here are key terms for your quick reference as you are evaluating your life insurance options:

- Death Benefit: The amount of money paid out to your beneficiaries if you die during the term of the policy.

- Premium: Your payment to the insurance company to keep the term life insurance policy active. The higher the death benefit, the higher the premium.

- Insured: is the individual whose life is covered by the policy.

- Beneficiary: The person or entity you designate to receive the death benefit if you, the insured person, die during the policy term.

- Policyholder: The individual who owns the term life insurance policy and is responsible for paying the premiums. This person may, or may not, be the insured.

- Term: The length of time the life insurance policy is in effect. Common terms are 10, 15, 20, or 30 years. After your policy’s term ends, your coverage typically ceases unless the policy is renewed or converted.

- Underwriting: The process your insurance company uses to assess the risk of insuring you, the applicant. This process often involves evaluating your health, lifestyle, medical history to determine the premium.

- Conversion Option: A feature that allows you, the policyholder, to convert a term life insurance policy into a permanent life insurance policy without undergoing a new medical examination. Typically, a conversion option is only available for a predetermined period within the term of your policy.

- Renewable Term: A term life insurance policy that can be renewed at the end of the term without a medical exam. However, the premium may increase based on the insured’s age at the time of renewal.

- Rider: An additional provision or benefit added to a life insurance policy, often at an extra cost. Common riders for term life insurance include waiver of premium, accidental death, and accelerated death benefit.

- Binder: A temporary agreement issued by the insurance company that provides proof of insurance coverage until a permanent policy is issued. It shows that the insurance policy is in force from the date of application until your policy is formally issued or declined.

- Contract Date: The effective date on which your term life insurance policy begins. This is the date from which your policy’s term is measured and is typically found in your policy document.

The Next Step

When you know who and what are truly important, you can create incredible clarity about your spending and saving.

Clarity to confidently spend on things that matter. Clarity to avoid spending your hard-earned resources on things that aren’t aligned with what you want in life.

As your financial planner in Saint Louis, we can help you plan for the future and enjoy the present moment.

Start feeling more confident that you are making progress toward your savings priorities.

Proactive and open collaboration with your financial, tax, and estate planning professionals can help you work towards your financial goals. Working with your financial planner in Saint Louis can provide you with the right mix of accountability, collaboration, and long-term thinking.

If you’re unsure about your next step, let’s talk.

Disclosure

This commentary is provided for educational and informational purposes only and should not be construed as investment, tax, or legal advice. The information contained herein has been obtained from sources deemed reliable but is not guaranteed and may become outdated or otherwise superseded without notice. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decision.