An employee stock purchase plan (ESPP) allows you to buy shares of stock in your employer. You can often buy shares with up to a 15% discount in a qualified ESPP. When you understand key terms, rules, and considerations, you can make more informed and tax-aware choices. Explore the key elements to consider when selling your ESPP shares in this educational overview. Feel more confident and prepared during your next ESPP enrollment window.

Learning Points

Overview of Employee Stock Purchase Plans (ESPP)

If your employer’s stock is publicly traded in the United States, you may be eligible to participate in an employee stock purchase plan as part of your employee benefits package. You might know it as your company’s ESPP.

One of the key features of an ESPP is that it allows eligible employees to purchase company shares at a discounted price through after-tax payroll deductions.

The discount can be as high as 15% for a qualified employee stock purchase plan. Meaning, as an ESPP-eligible employee, you could elect to purchase company stock at a price significantly below its current fair market value.

The ESPP’s discount percentage is set by each company. Generally, you can expect to see this vary between 5%-15% for qualified ESPPs. Some ESPPs provide no discount. And so, if you find yourself discussing different ESPP offerings with a friend or member of your family, you could see some variation in this discount percentage from one company to another.

For this discussion, we’ll assume you are eligible to participate in a qualified employee stock purchase plan.

Meaning, the ESPP fulfills the related regulatory requirements of Section 423 of the Internal Revenue Code. You’ll want to confirm with your employer whether your ESPP qualifies.

In the context of your family’s investment goals, holding a significant portion of your wealth in your company’s stock can increase the concentration risk of your investments. Doing so can decrease your investment portfolio’s diversification and could potentially take you away from achieving your financial goals.

You’ll want to evaluate your employee stock purchase plan in the context of your personal situation.

Read on to explore your key tax planning considerations around selling your ESPP shares.

Selling Your ESPP Shares: Qualifying and Disqualifying Dispositions

When you sell your employee stock purchase plan shares, there are two ways your ESPP share sales are characterized:

- Qualifying Disposition, or

- Disqualifying Disposition

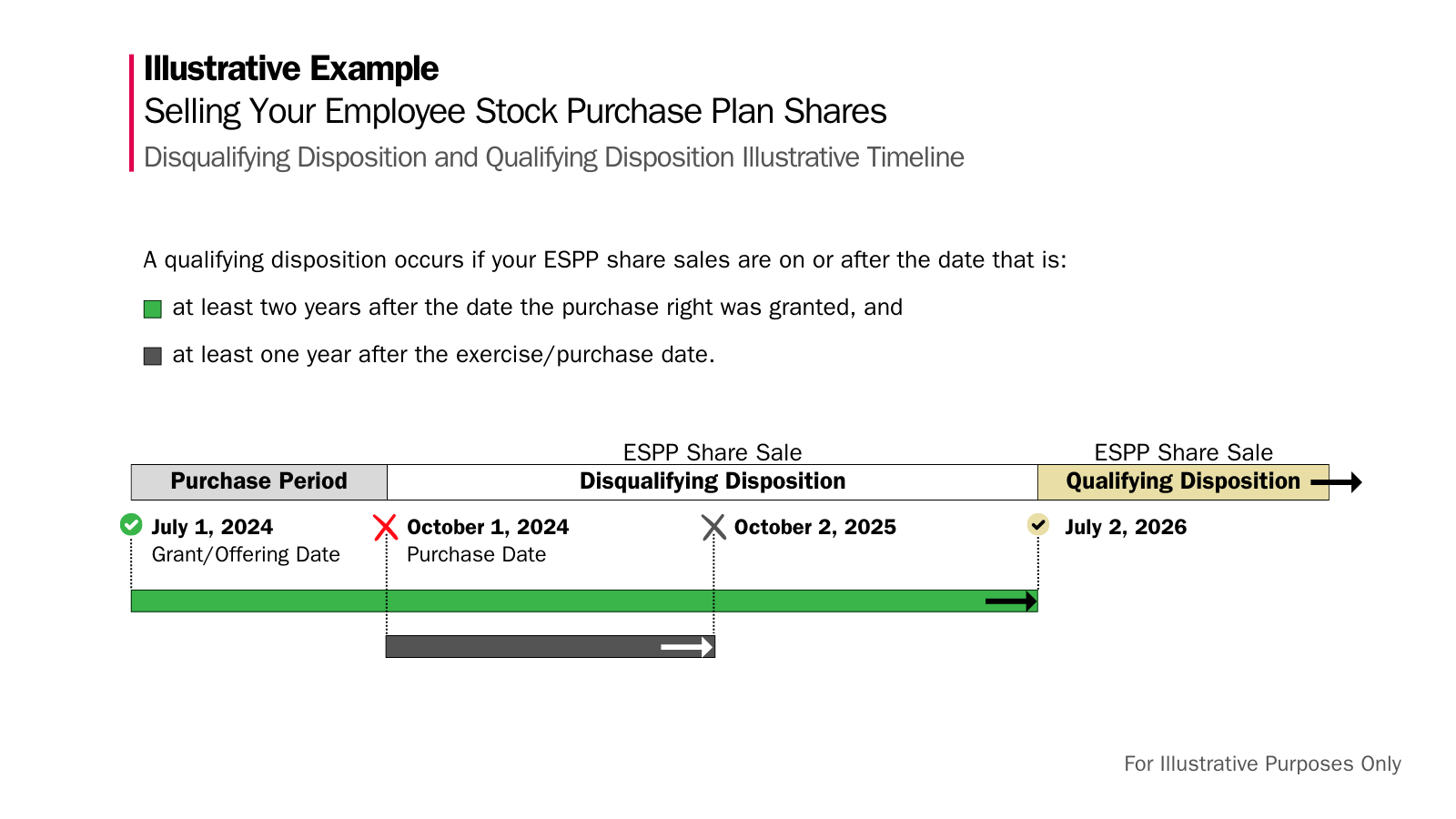

Below is an illustrative example that ties together key concepts and terms you might encounter when you are evaluating whether to continue to hold or sell your ESPP shares.

Let’s dive into the details of when your ESPP shares are characterized as a qualifying and disqualifying disposition.

Qualifying Disposition

A qualifying disposition occurs if you sell your ESPP shares on or after the date that is at least:

- two years after the date the purchase right was granted, and

- one year after the exercise date.

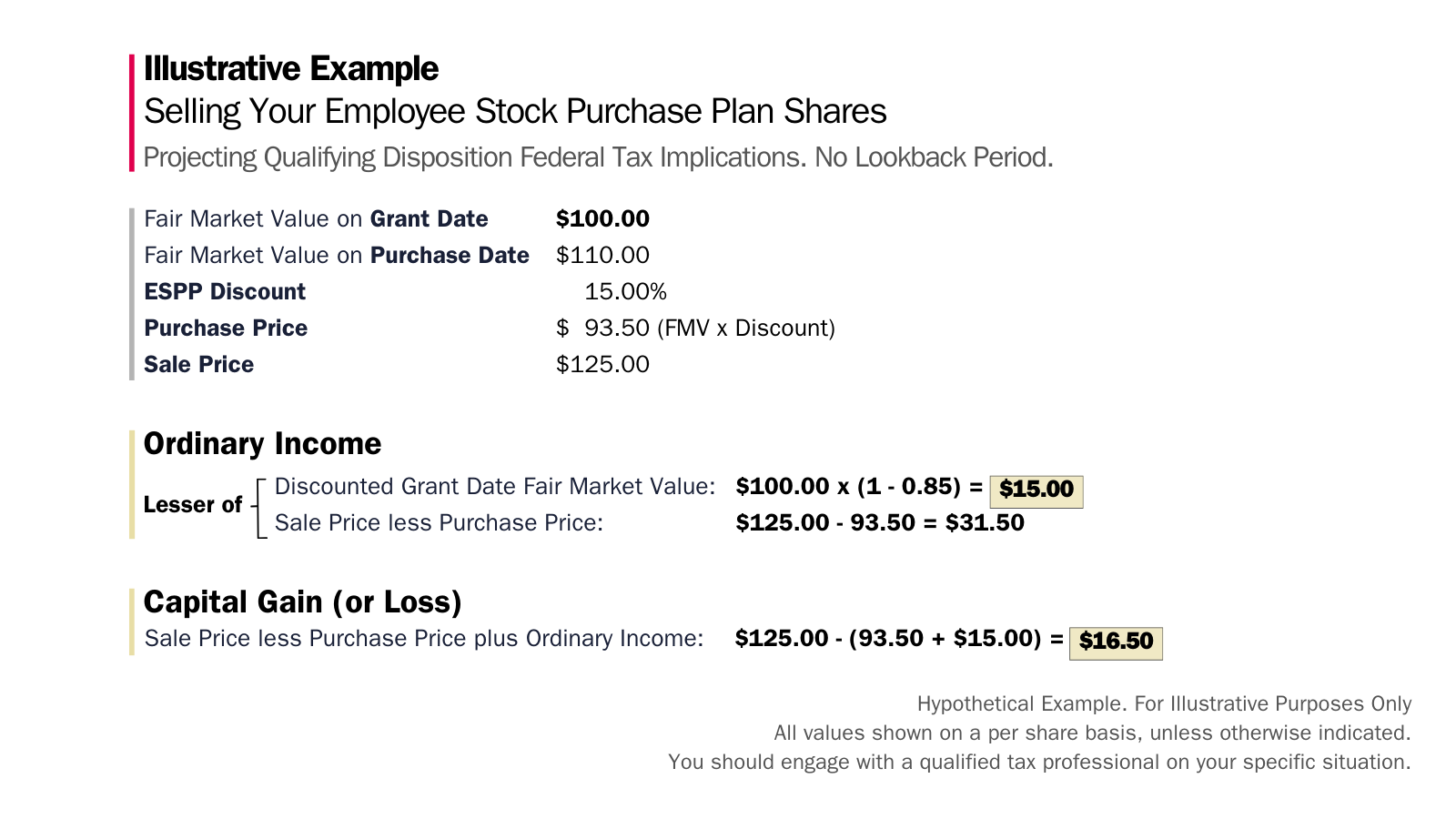

In a qualifying disposition, you allocate the sale of ESPP shares into ordinary income and capital gains/losses, and you can project your taxes in the following way:

Ordinary Income: If the fair market value of the shares at the time the purchase rights were granted is below the exercise price at the date of grant, you can project as ordinary income, the lesser of:

- The excess of the fair market value of the shares as of the grant date over the exercise price. (i.e., the discounted amount of the share price), or

- The excess of the fair market value of the shares at the time of sale over the amount paid for the shares.

Capital Gain/Capital Loss: Any further gain or loss on the disposition will be treated as capital gain or capital loss, respectively.

Here is an illustrative example of a qualifying disposition.

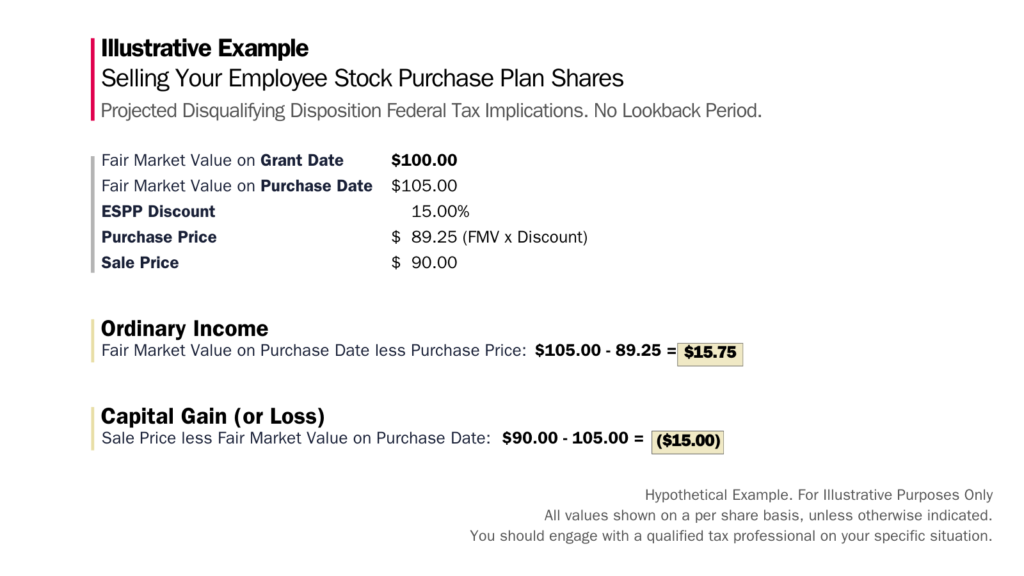

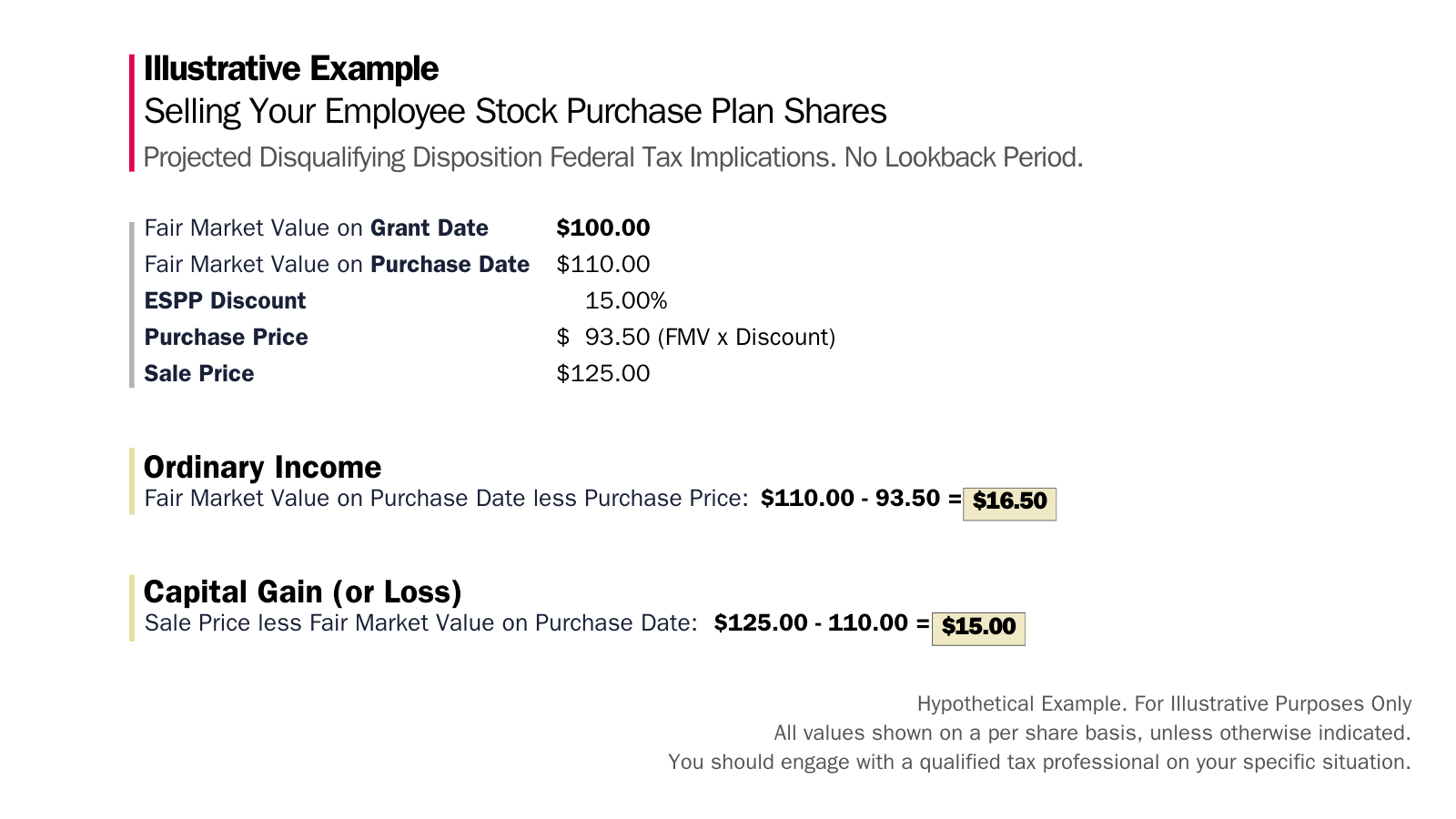

Disqualifying Disposition

If you sell shares of stock acquired through your ESPP before the expiration of either of the holding periods described in the qualifying disposition above, the excess of the FMV of the shares on the exercise date over the exercise price will be treated as ordinary income to the employee in the year of the disposition.

This excess will constitute ordinary income in the year of sale or other disposition, even if no gain (or a loss) is realized on the sale (or a gratuitous transfer of the shares is made).

The balance of any gain will be treated as capital gain. Even if the shares are sold for less than their FMV on the exercise date, the same amount of ordinary income is attributed to an employee, and a capital loss is recognized equal to the difference between the sale price and the FMV of the shares on the exercise date.

For a more detailed discussion on investment taxes, the following article provides additional insights.

Hopefully this framework gives you a sense of the timing and considerations around participating in your employee stock purchase plan. Topics like your ESPPs, like so many others in financial planning, intersect with the world of tax, make sure you coordinate with a qualified tax professional on your specific situation.

To help you better understand the relationship between the different terms and sale timing, here are illustrative examples of both a disqualifying disposition for a loss and a gain, respectively.

Setting aside the right amount for your tax payments: Once you have a reliable projection of how your share sales will be taxed, set aside those funds in an account you earmarked to hold your future tax payments.

If you’re unsure how to do this, here is a brief piece walking through one way to approach it.

ESPP-related Tax Forms

After you sell shares related to your Employee Stock Purchase Plan, you’ll want to have a plan in place for how will handle the tax related items, and/or coordinate closely with your qualified tax professional.

Because topics like employee stock purchase plans, like so many others in financial planning, intersect with the world of tax, make sure you coordinate with a qualified tax professional.

Assuming your company has a qualified ESPP, you should be familiar with the follow tax forms and how they relate to your Employee Share Purchase Plan.

You can also check whether the custodian/brokerage firm holding your ESPP shares offers an annual tax guide. Remember to confirm whether your Employee Stock Purchase Plan is qualified.

W-2: Your employer should provide this to you each year. Your W-2 should include the taxable income from your ESPP share sale. It might not, and so you’ll want to verify that your W-2 accurately reflects any share sale(s). Keep in mind that the ESPP share sale shown on your W-2 will not have any corresponding withholding for income tax.

Form 3922: Your employer should provide this to you for each tax year if you participated in your ESPP. This will show all the details relating to your ESPP share purchases and sales.

Form 1099-B: You should receive this during tax season after you sell your ESPP shares. This documentation specifies your cost basis, as well as help you characterize the short-term or long-term nature of your sale as a gain or loss.

Does participating in your ESPP align with your goals?

Like any investment, you want to understand how to purchase, maintain, and sell the shares associated with your employee stock purchase plan.

It’s important to maintain your perspective, too. Whether you want to continue to hold the stock will depend on your goals and personal financial situation. You’ll want to understand how an ESPP can support your overall financial goals. Whether that means you diversify your investments away from your employer’s stock to achieve your financial goals or continue to hold the shares for a specific purpose.

When an ESPP is one of the many pieces of your financial life, it’s important that you proactively and efficiently review, monitor, and take action on your ESPP-related holdings.

Because topics like employee stock purchase plans, like so many others in financial planning, intersect with the world of tax, make sure you coordinate with a qualified tax professional.

Once you understand the terms and conditions of your employee stock purchase plan, and how they apply to your personal situation, the more accurately you can plan for when you are eligible to participate in your company’s employee stock purchase plan.

When you know where you’re going financially and know who and what are truly important to you in life, you can create incredible clarity about your spending and saving.

You can confidently save for and spend on the things that matter, and confidently avoid those things that are not aligned with what you want in life.

It’s within this context you can assess and quantify how your ESPP does, or does not, align with your goals. It’s easy to get lost in the details and lose sight of what truly matters.

Other Common Topics to Know About Your ESPP

An Employee Stock Purchase Plan will define the key terms and provide specific guidance on how participants can engage with the plan. Here are some common topics that you will want to understand for your ESPP.

Voting and Other Stockholder Related Rights: Once you purchase shares through your ESPP, it’s important to recognize that you have shareholder rights associated with your ownership.

Dividends: You will want to know how you receive dividends on purchased shares of stock. Specifically, you should know whether you can elect to receive dividends in cash or use them to purchase shares at the fair market value.

Fractional Shares: Understand whether your plan allows you to purchase fractional shares. If your Employee Stock Purchase Plan does not allow fractional share purchases, understand how those excess/unused contributions are treated.

No interest: While your payroll deductions accumulate before the purchase date, understand whether those dollars are earning interest. Your employee stock purchase plan should be able to address this point.

Beneficiary: When you establish your ESPP account, you’ll want to make sure you name who you want as a beneficiary on the account. The beneficiary designation allows you to specify who receives your account’s assets after you are gone. A beneficiary can be an individual or entity. A beneficiary does not have any ownership rights, access, or control of an account while you are alive.

Beneficiary designations are a key element of your estate plan. Your beneficiary designations ensure your assets are passed along according to your wishes. It can be easy to overlook beneficiary designations on your accounts.

If you’d like to quick refresher on beneficiary designations, you can read this short piece.

The Next Step

When you know who and what are truly important, you can create incredible clarity about your spending and saving.

Clarity to confidently spend on things that matter. Clarity to avoid spending your hard-earned resources on things that aren’t aligned with what you want in life.

As your financial planner in Saint Louis, we can help you plan for the future and enjoy the present moment.

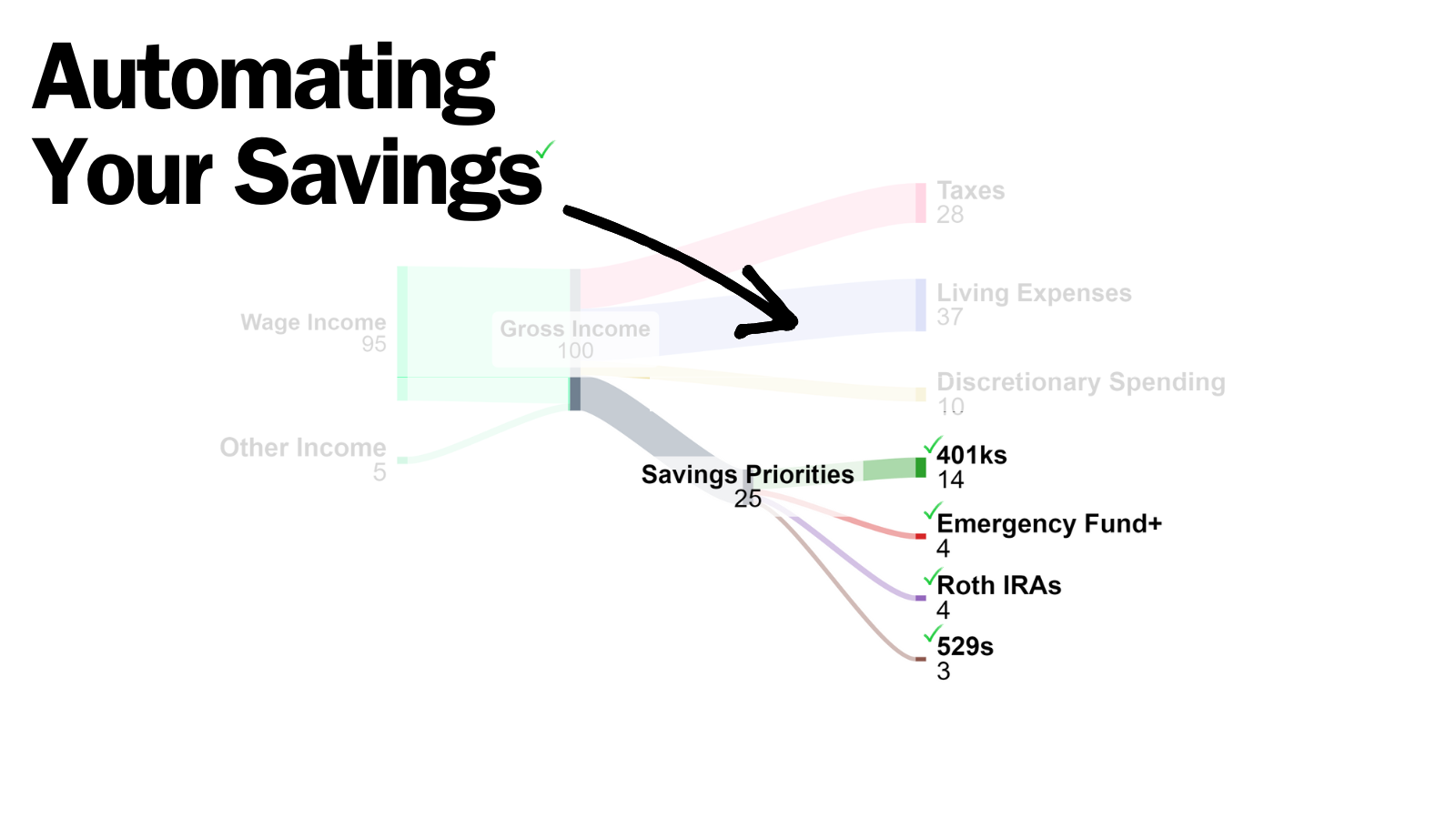

Start feeling more confident that you are making progress toward your savings priorities and know whether participating in your employee stock purchase plan aligns with your goals.

Proactive and open collaboration with your financial, tax, and estate planning professionals can help you work towards your financial goals. Working with your financial planner in Saint Louis can provide you with the right mix of accountability, collaboration, and long-term thinking.

If you’re unsure about your next step, let’s talk.

Disclosure

This commentary is provided for educational and informational purposes only and should not be construed as investment, tax, or legal advice. The information contained herein has been obtained from sources deemed reliable but is not guaranteed and may become outdated or otherwise superseded without notice. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decision.